Existing customer? Sign in

Save with Fidelity Investments TurboTax Discount

Are you looking for ways to save on your tax preparation expenses? Look no further than Fidelity Investments TurboTax discount. By taking advantage of this exclusive offer, you can simplify your tax filing process and keep more money in your pocket. But how does it work, and who is eligible for this discount? Let’s explore the details and benefits of the Fidelity TurboTax discount.

Key Takeaways:

- Save on tax preparation expenses with Fidelity Investments TurboTax discount.

- Streamline your tax filing process and maximize your savings.

- Learn how the Fidelity TurboTax partnership benefits you and your financial portfolio.

- Find out who is eligible for the Fidelity TurboTax discount.

- Discover the steps to redeem your Fidelity TurboTax discount.

Introduction to Fidelity’s TurboTax Discount Offer

Fidelity Investments has partnered with TurboTax to provide an exclusive discount on tax preparation services. This collaboration aims to help customers save money while simplifying the tax filing process. If you’re a Fidelity customer, this discount can be a valuable opportunity to maximize your tax savings.

By taking advantage of Fidelity’s TurboTax discount, you can access significant savings on your tax preparation expenses. The discount enables you to reduce the cost of TurboTax software and services, allowing you to keep more of your hard-earned money.

Who Is Eligible for Fidelity’s TurboTax Offer

The Fidelity TurboTax offer is available to Fidelity customers who meet certain criteria. Generally, individuals with a Fidelity Cash Management Account or other qualifying Fidelity accounts can qualify for this discount. Details regarding eligibility requirements can be found on Fidelity’s website.

Understanding the Fidelity Investments TurboTax Discount

In this section, we will explore the benefits and features of the Fidelity Investments TurboTax discount, helping you gain a comprehensive understanding of how it can save you money on tax preparation. By taking advantage of this discount, you can make informed decisions about using TurboTax and maximize your savings during tax season.

TurboTax is a leading tax preparation software that simplifies the filing process and helps individuals and businesses navigate the complexities of tax regulations. Fidelity Investments, a trusted financial services company, has partnered with TurboTax to offer exclusive discounts to its customers. This partnership allows Fidelity customers to access TurboTax at a discounted rate, providing them with significant cost savings.

The Fidelity Investments TurboTax discount offers several benefits:

- Savings: By utilizing the discount, you can reduce your tax preparation expenses and keep more money in your pocket.

- Convenience: TurboTax’s user-friendly interface and comprehensive step-by-step guidance make it easy to navigate the tax filing process.

- Accuracy: TurboTax’s advanced software helps minimize errors and ensures that your tax return is accurate.

- Security: TurboTax prioritizes data security, safeguarding your personal and financial information throughout the filing process.

“The Fidelity Investments TurboTax discount provides an opportunity for Fidelity customers to save money while benefiting from TurboTax’s industry-leading tax preparation software.”

By understanding the specifics of the Fidelity TurboTax discount, you can make an informed decision about leveraging this valuable offer. Whether you’re an individual or a business, the Fidelity Investments TurboTax discount can help streamline your tax preparation process and maximize your tax savings.

Steps to Redeem Your Fidelity TurboTax Discount

In order to take advantage of the Fidelity TurboTax discount, follow these steps to redeem your savings:

Accessing the Discount Through Fidelity’s Website

To access the Fidelity TurboTax discount, you need to visit Fidelity’s website and log in to your account. Once you’re logged in, navigate to the “Benefits & Rewards” section, where you’ll find information about the TurboTax offer. Click on the designated link to proceed to the TurboTax website.

On the TurboTax website, you may be prompted to log in if you already have an account or create a new account if you’re a new user. Make sure to use the same email address associated with your Fidelity account for a seamless redemption process.

TurboTax Products Eligible for the Fidelity Discount

Not all TurboTax products are eligible for the Fidelity discount. When selecting the TurboTax product that best suits your needs, ensure it qualifies for the Fidelity discount by checking the product details and specifications. Eligible products may include TurboTax Deluxe, Premier, or Self-Employed, depending on your tax situation.

Once you have chosen the appropriate TurboTax product, proceed with the checkout process. The Fidelity TurboTax discount will be automatically applied, and you will see the reduced price displayed.

By following these simple steps, you can easily redeem your Fidelity TurboTax discount and maximize your savings on tax preparation.

Maximizing Your Savings with Fidelity TurboTax Promo

In this section, we will explore strategies for maximizing your savings with the Fidelity TurboTax promo. To unlock the full potential of the discount, consider utilizing it for investment-based tax returns, such as an Individual Retirement Account (IRA). By taking advantage of the Fidelity TurboTax partnership, you can not only save on your tax preparation expenses but also enhance your financial portfolio by integrating tax strategies with investment management.

One effective way to maximize your savings is by utilizing the fidelity ira turbotax discount. If you have an IRA account with Fidelity Investments, you can leverage this discount to streamline your tax filing process. TurboTax offers a range of products specifically designed for investment-related tax scenarios, allowing you to accurately report your IRA contributions, conversions, and distributions.

The fidelity turbotax partnership provides numerous benefits for investors. By integrating tax strategies with investment management, you can optimize your financial portfolio and take advantage of potential tax-saving opportunities. With TurboTax’s intuitive interface and comprehensive guidance, you can confidently navigate complex tax laws and ensure accurate reporting, all while maximizing your savings.

Benefits of Maximizing Your Savings with Fidelity TurboTax Promo:

- Access to investment-specific tax guidance

- Ensuring accurate reporting of IRA contributions, conversions, and distributions

- Maximizing deductions and credits related to your investments

- Streamlined tax preparation process

- Integration of tax strategies with investment management

- Ongoing support and guidance from TurboTax’s expert resources

By leveraging the fidelity ira turbotax discount and taking advantage of the fidelity turbotax partnership, you can not only save money on your tax preparation but also optimize your financial portfolio based on tax-efficient strategies. With the help of TurboTax’s user-friendly platform and expert guidance, you can confidently navigate the complexities of investment-related tax scenarios and ensure accurate reporting, ultimately maximizing your savings.

Fidelity TurboTax Discount Code: How to Apply

Navigating the Fidelity Website for Discount Codes

Applying the Fidelity TurboTax discount code is a straightforward process that can help you save on your tax preparation expenses. The first step is to navigate the Fidelity website to find and access the discount codes. Here’s a step-by-step guide to help you through:

- Visit the Fidelity Investments website and log in to your account using your credentials.

- Once logged in, navigate to the specific section or page where the TurboTax discount codes are available.

- Look for any instructions or prompts related to the discount codes. Fidelity may provide specific instructions on how to access and apply the codes.

- Search for the Fidelity TurboTax discount code or enter keywords like “TurboTax discount” in the search bar to find the relevant webpage or section.

- Open the webpage or section that contains the discount codes.

- Copy the discount code(s) displayed on the webpage. Make sure to copy the code accurately to ensure a successful application.

Once you have navigated the Fidelity website and successfully obtained the discount code, you are ready to apply it during your TurboTax checkout process.

Troubleshooting Common Issues When Applying the Discount

Although applying the Fidelity TurboTax discount code is a simple process, you may encounter some common issues along the way. Here are a few troubleshooting tips to help you resolve any problems you may face:

- Double-check the discount code for accuracy. Ensure that you have copied it correctly and without any extra spaces or characters.

- Verify that the discount code is still valid. Sometimes codes have expiration dates or usage limits, so it’s important to check their validity.

- Ensure that you meet all the eligibility requirements for using the discount code. Some codes may have specific criteria or may only apply to certain TurboTax products.

- If you are encountering technical issues with the Fidelity website or the TurboTax checkout process, try clearing your browser cache and cookies or switching to a different browser.

- If the discount code is still not working, contact Fidelity Investments customer support for assistance. They can help troubleshoot the issue and provide further guidance.

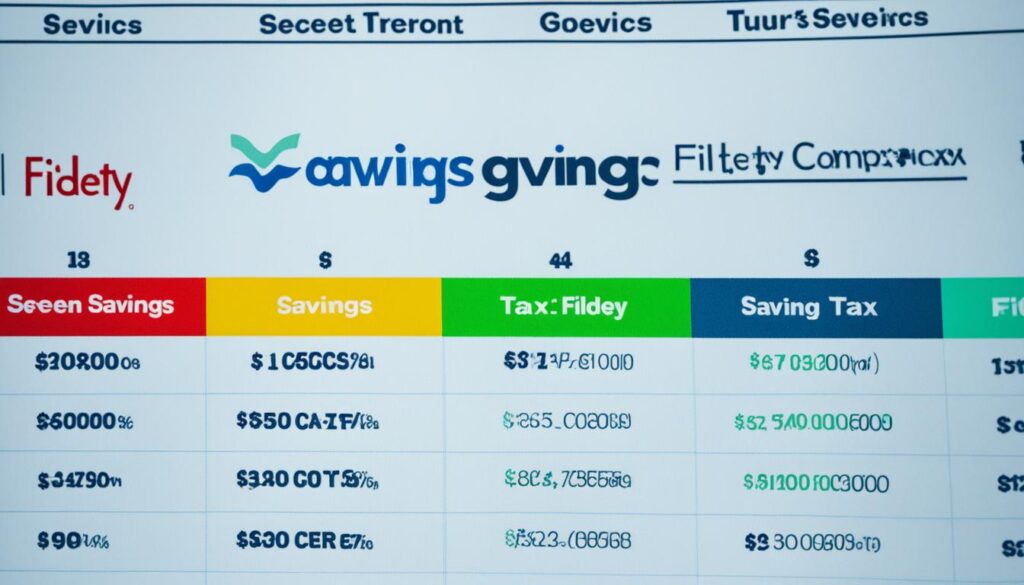

Comparing Fidelity Investments TurboTax Discount to Other Offers

In this section, we will compare the Fidelity Investments TurboTax discount to other offers available in the market. By examining the features, savings potential, and user experience of the Fidelity TurboTax discount, you can make an informed decision about the best option for your tax preparation needs. We will highlight the unique benefits of the Fidelity discount and how it sets itself apart from other offers.

When it comes to tax preparation, finding the right discount can make a significant difference in your savings. Fidelity Investments offers a TurboTax discount that is worth considering. However, it’s essential to compare it with other offers to ensure you’re getting the best deal.

One of the key advantages of the Fidelity TurboTax discount is its integration with Fidelity Investments’ services. If you already have a Fidelity Cash Management Account, the discount seamlessly integrates with your account, making it convenient and easy to use.

“The Fidelity TurboTax discount is a game-changer for Fidelity customers. It not only saves them money but also simplifies the tax preparation process.” – Financial expert

In terms of savings potential, the Fidelity TurboTax discount offers competitive rates. The discount can help you save a significant amount on tax preparation fees, allowing you to keep more money in your pocket.

Another factor to consider is user experience. TurboTax is known for its user-friendly interface and step-by-step guidance, which makes tax preparation less daunting. By opting for the Fidelity TurboTax discount, you can enjoy the benefits of TurboTax’s intuitive software combined with the convenience of Fidelity’s platform.

When comparing offers, it’s important to consider the specific needs of your tax return. Some offers might be more tailored to certain tax situations, such as self-employment or investment income. Therefore, it’s crucial to evaluate the eligibility and suitability of each offer.

| Features | Fidelity TurboTax Discount | Competitor Offer 1 | Competitor Offer 2 |

|---|---|---|---|

| Savings Potential | High | Medium | Low |

| User Experience | Seamless integration with Fidelity platform | Intuitive interface | Less user-friendly |

| Tax Situation Suitability | Flexible for various tax situations | Optimized for self-employment | Specialized for investment income |

As you can see from the comparison, the Fidelity TurboTax discount offers high savings potential, a seamless integration experience, and versatility for various tax situations. These advantages place it ahead of other offers in the market.

By carefully evaluating the features and benefits of different tax preparation offers, you can make an informed decision that aligns with your specific needs and maximizes your savings. The Fidelity TurboTax discount stands out as a top contender, providing a comprehensive solution for effective and cost-efficient tax preparation.

The Fidelity TurboTax Partnership: Tax-Smart Investing

In this section, we will delve deeper into the Fidelity TurboTax partnership and its benefits for tax-smart investing. The partnership between Fidelity Investments and TurboTax offers a unique opportunity to optimize your financial portfolio by integrating tax strategies with investment management. This collaboration aims to help you make the most of your investments while maximizing tax savings.

Integrating Tax Strategies with Investment Management

The Fidelity TurboTax partnership allows you to seamlessly combine your tax planning and investment strategies. By integrating tax strategies into your investment management, you can effectively minimize your tax liability, potentially increasing your after-tax investment returns. This collaborative approach ensures that your investment decisions align with your tax goals, optimizing your overall financial strategy.

Enhancing Your Financial Portfolio with Tax Savings

One of the primary benefits of the Fidelity TurboTax partnership is the potential for significant tax savings. By leveraging the expertise and resources of both Fidelity Investments and TurboTax, you can take advantage of various tax deductions and credits, ultimately reducing your tax burden. These tax savings can be reinvested back into your financial portfolio, helping you achieve your long-term financial goals.

The Fidelity TurboTax partnership offers a powerful combination of tax expertise and investment management to enhance your financial well-being. Through the integration of tax strategies and investment decisions, you can optimize your portfolio and potentially maximize your returns. Take advantage of this partnership and unlock the benefits of tax-smart investing with Fidelity and TurboTax.

Conclusion

Now that you have learned about the Fidelity TurboTax offer, you can capitalize on this discount to streamline your tax filing process and maximize your savings. To recap, here are the key steps to redeem your Fidelity TurboTax discount:

- Access the Fidelity website and navigate to the relevant section for the discount.

- Choose the TurboTax product that suits your tax filing needs and is eligible for the Fidelity discount.

- Apply the Fidelity TurboTax discount code during the checkout process to unlock the savings.

By following these steps, you can take advantage of the Fidelity TurboTax offer and enjoy the benefits it brings to your financial planning.

Final Thoughts: Preparing for Tax Season with Fidelity

As tax season approaches, it’s crucial to have a comprehensive plan in place to ensure a smooth and efficient filing process. By partnering with TurboTax, Fidelity Investments offers you a valuable opportunity to save on your tax preparation expenses. The Fidelity TurboTax discount code allows you to leverage this partnership and make the most of your financial portfolio.

By choosing Fidelity for your tax season needs, you gain access to innovative tools, expert guidance, and seamless integration with your investment management. This combination enables you to optimize your tax strategies, maximize your savings, and enhance your overall financial well-being.

So, as you gear up for tax season, don’t miss out on the benefits that Fidelity Investments and TurboTax can provide. Take advantage of the Fidelity TurboTax offer and embark on a tax-smart investing journey that will boost your financial success.

FAQ

How does the Fidelity Investments TurboTax discount work?

Who is eligible for Fidelity’s TurboTax offer?

What are the benefits of the Fidelity TurboTax discount?

How can I redeem my Fidelity TurboTax discount?

Which TurboTax products are eligible for the Fidelity discount?

How can I maximize my savings with the Fidelity TurboTax promo?

How do I apply my Fidelity TurboTax discount code?

How does the Fidelity TurboTax discount compare to other offers?

How does the Fidelity TurboTax partnership benefit tax-smart investing?

Source Links

- https://prettysweet.com/turbotax-fidelity-discount/

- https://www.process.st/how-to/get-fidelity-discount-on-turbotax/

- https://www.mymoneyblog.com/fidelity-free-turbotax-offer.html